When you’re trying to understand your credit, one of the most helpful things you can learn is that not all credit works the same way. Different types of credit affect your score differently, cost different amounts, and fit different stages of your financial life. This guide breaks everything down so you can make better decisions and avoid surprises.

1. An Overview of the Three Main Credit Types

There are three major types of credit you’ll see throughout your life:

- Revolving credit

- Installment credit

- Open credit

Each type works differently, and lenders use them to judge how responsible you are with borrowing. The Consumer Financial Protection Bureau (CFPB) gives a helpful breakdown of how credit accounts appear on your reports.

2. Revolving Credit Explained (Credit Cards & Lines of Credit)

Revolving credit is the type you probably deal with most often. The most common example is a credit card.

Here’s how revolving credit works:

- You get a credit limit.

- You borrow against that limit whenever you spend.

- You choose how much to pay each month.

- Your unpaid balance can grow with interest.

Revolving credit strongly affects your credit utilization, one of the biggest scoring factors. According to Experian, keeping utilization below 30% is generally better for your credit score.

3. Installment Credit Explained (Loans You Pay Over Time)

Installment credit works very differently from revolving credit. With installment credit, you borrow a fixed amount and repay it in equal monthly payments over a set period.

Common installment loans include:

- Auto loans

- Student loans

- Personal loans

- Mortgages

These accounts help your payment history and credit mix, both of which contribute to your score. According to FICO, payment history makes up the largest part of your credit score.

4. Open Credit Explained (Pay-in-Full Accounts)

Open credit accounts require you to pay the full balance every month. There’s no option to carry a balance.

Examples include:

- Charge cards

- Certain utility accounts

- Some membership-based billing systems

Not all open credit accounts report to the credit bureaus, but the ones that do help show consistency and responsible payment behavior.

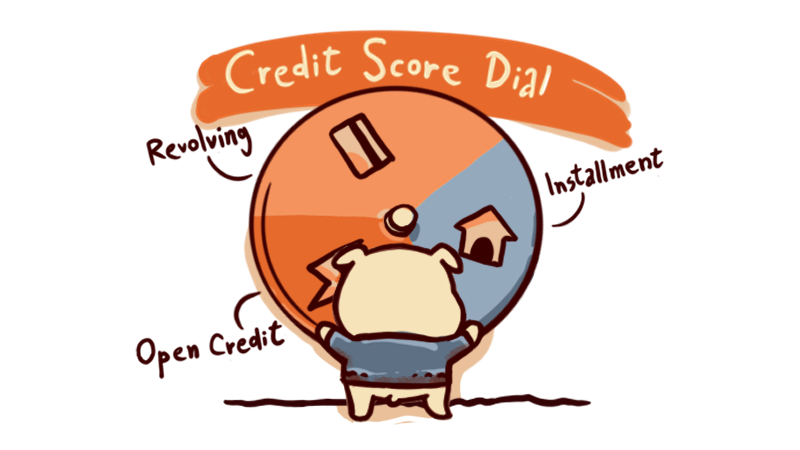

5. How Each Type of Credit Impacts Your Credit Score

Each credit type influences your score in different ways.

Revolving credit impacts:

- Credit utilization

- Payment history

- Length of credit

- New inquiries

Installment credit impacts:

- Payment history

- Credit mix

- Average age of credit

Open credit impacts:

- Payment history (if reported)

- Credit mix

Because revolving accounts can change every month, they tend to move your score up or down more quickly than installment loans.

6. Which Type of Credit Is Easiest to Get First?

If you’re new to credit, you have several starter-friendly options:

- Secured credit cards — You place a deposit, and the card reports like a normal credit card. The CFPB explains these in more detail here.

- Student loans — Many people begin building credit through federal student loans.

- Credit-builder loans — These help you build history by making small monthly payments into a locked savings account.

- Authorized user accounts — Someone with good credit adds you to their credit card.

You don’t need all of them. Starting with one or two is enough to establish credit.

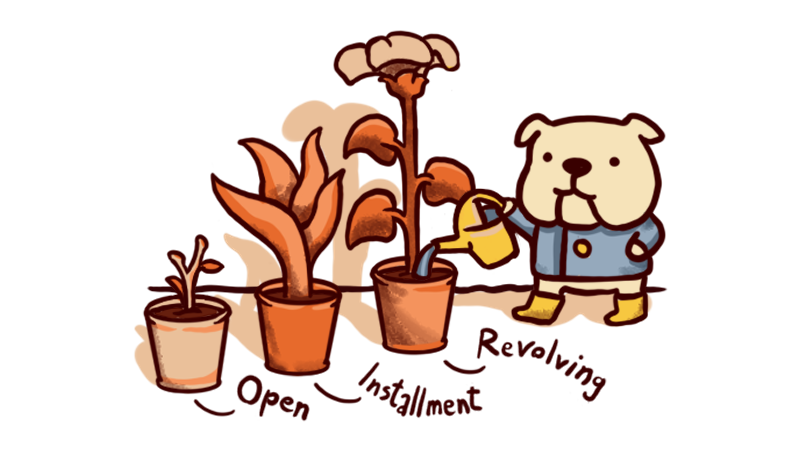

7. Which Type of Credit Helps Your Score the Most?

All three types of credit can help your score, but in different ways.

Fastest short-term improvement:

Revolving credit — especially when you keep balances low.

Best for long-term stability:

Installment loans — consistent payments over many years help build a strong credit profile.

Best for credit mix:

A combination of revolving and installment credit.

8. Which Type of Credit Costs the Most?

The cost of credit can vary a lot depending on which type you use.

Revolving credit:

Usually the most expensive because credit cards tend to have high interest rates if you carry a balance.

Installment loans:

Costs depend on your credit score, loan type, and loan term. Mortgages and auto loans typically have lower rates than credit cards.

Open credit:

Usually interest-free, but failing to pay in full can lead to account closures or collections.

The CFPB explains APR here:

Understanding APR vs. Interest Rate

9. How to Build a Balanced Credit Profile

A healthy credit profile doesn’t mean having as many accounts as possible. It means having the right mix and managing them responsibly.

A balanced profile often includes:

- One or two credit cards

- One installment loan (auto, student, personal, or credit-builder loan)

- Low balances

- On-time payments

Lenders feel more confident when they see you can handle different types of credit.

10. What to Avoid with Each Type of Credit

Each credit type comes with its own risks. Here’s what to watch out for:

Revolving credit:

- High balances

- Late payments

- Maxing out cards

- Opening too many accounts quickly

Installment credit:

- Borrowing more than you can comfortably repay

- Stretching loans into long, expensive terms

- Missing monthly payments

Open credit:

- Failing to pay in full

- Ignoring utility bills or memberships that can be sent to collections

11. Final Thoughts on Choosing the Right Types of Credit

When you understand how each type of credit works, you’re in a much better position to make smart financial choices. You don’t need every type of credit at once. Start with what makes sense for your life, build slowly, and focus on consistent on-time payments.

With good habits, you’ll create a strong credit foundation that supports your financial goals for years to come.